- August 7, 2024

- Posted by: admin

- Category: credit cash advance

- Long Prepared Episodes: If you anticipate to inhabit your fixer-higher through the construction, decide to station all of your current patience as you survive delays regarding the supply of content, performs stoppages on account of environment, or missed deadlines due the many idiosyncrasies that separate designers normally offer together to your worksite.

- Likewise have Chain Affairs: Almost certainly the greatest grounds causing much time wishing episodes and you can unforeseen delays in the functions will be the also provide strings, that has been riddled recently which have inefficiencies and shortages.

Know Their Capabilities…plus Limits

Fixer-uppers will have huge ideas. However, you will be including buying a massive union of your energy, opportunity, and money. Make certain you have all of them things in adequate also have before dive for the, and start to become reasonable on what you are able to do your self, what you need to price off to the advantages, as well as how long you might be willing to alive in to the an active structure zone. Curbed mag alerts one It is one thing to pick a fixer-top and this can be tackled that have cosmetics methods-particularly extract right up carpeting otherwise laying down tile-but it is another thing to buy a home who has got major architectural points. The latest magnitude of your enterprise you’re prepared to undertake will place the latest build for your home search.

Can you deal with a total teardown restoration or are you presently searching for something just means a good significant painting, carpeting, and you can like? You will find a big difference throughout the amount of money you’ll end up using and how far you can do in the place of hiring exterior let. Even before you start to find services, you must come in that have an effective sense of just how far upgrading you happen to be willing to would on the fixer-higher. This can help you sharpen during the for the functions whose requires try scaled to your budget, abilities, and you may patience.

long term installment loans no credit check direct lenders

Be aware of the History of the house

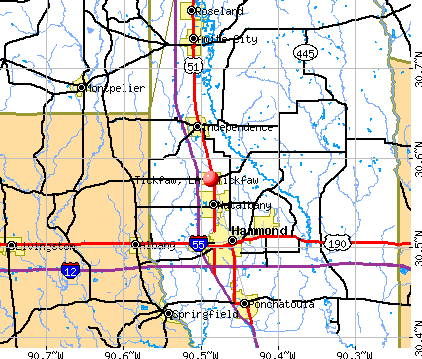

After you purchase a fixer-upper, you might be getting the history of the house or property as well as the chronic repairs point, all of the dated device, and every environmental position that include it. Analysis homework to know the complete reputation of the latest household together with its years, brand new schedule when it comes down to significant renovations, the fresh relative chronilogical age of essential have including the rooftop and window, and you will situations that might features expected major solutions over the years along with toward foundation, chimneys, cellar, etcetera. You will also wish to know whether the family have a history away from flood, leaking, termites, plus. Speak to the seller otherwise realtor, read what you can be concerning range of earlier in the day occupants. If in case you really need to look better, you can try contacting the fresh Department off Information to your local government where the property is receive. Which agency can render particular understanding of the fresh genuine period of the dwelling, prior title holders and you can the means to access the brand new homes, and you may one permits which were drawn to own home improvements and fixes over the lifespan of the property.

Perform an enthusiastic Thorough Examination

An examination is obviously a significant area of the real estate techniques. Even when you’re to buy a home that’s basically the newest and you may well-maintained, a check is a must. This can inform you undetectable factors, anticipate upcoming expenses and provide you with an entire knowledge of the fresh new home’s structural integrity. Most of these advantages undertake added importance which have good fixer-upper. Information what the family demands could be required to generating good experienced render to your possessions.

That is why, claims That it Dated Home, Its important that a residential property bargain become a review clause. At the best, this new review will to make sure your that home is good investment; at worst, it will help you straight back out from the deal. Often having fixer-uppers, it’s some thing around. The newest inspector commonly file a significant state otherwise a few, and you may use the findings to discover the seller so you can buy solutions otherwise discuss new sales price down.